Municipal debt markets can cater to everyone from a conservative investor looking for principal protection while earning enough to keep up with inflation to a moderate risk-taker who might be looking for high returns.

The new wave of green municipal debt instruments has many investors talking and potentially looking to make them part of their portfolio. The Municipal Securities Rulemaking Board (MSRB) states that green bonds are fixed-income debt instruments like any other bond. They offer a stated return and a promise to use the proceeds to finance or refinance, in part or fully, new or existing sustainable projects.

Generally, green bonds fund environmental, social and governance improvements or projects, and are issued by the public, private or multilateral entities to finance projects related to a more sustainable economy and that generate identifiable climate, environmental or other benefits. These projects may include renewable energy and energy efficiency projects, clean public transportation, pollution prevention and control, conservation, sustainable water and wastewater management, and green buildings that meet internationally recognized standards and certifications.

In this article, we will take a closer look at the rise of green debt issuance by public agencies and how an investor can meet his/her long-term investment goals while staying environmentally responsible and aligning with their social values.

Be sure to check out our Education section to learn more about municipal bonds.

Understanding Green Debt

The impacts of climate change paired with the need to build more environmentally and socially responsible public infrastructures amplified the noise around green debt, and more agencies started issuing green debt to fund their respective projects.

As the name suggests, green municipal debt provides municipalities with a new source of capital to build green infrastructures such as rain barrels to conserve rainwater, permeable pavements, bioswales, etc., in order to have a positive impact on the environment and take the financial and resource strain off of local governments and various utilities. Many private-public partnerships are encouraging local governments to reevaluate their operations and potentially capitalize on the funding available through Environmental Impact Bonds (EIBs) or green bonds.

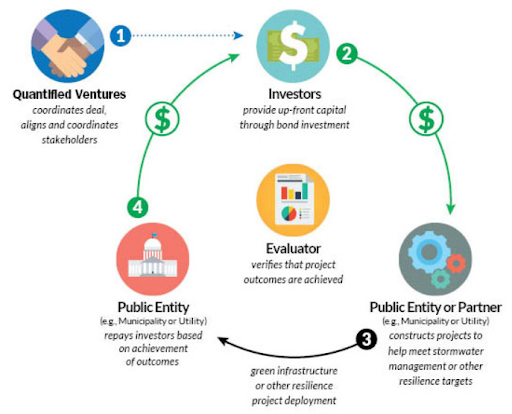

As shown in the diagram below, the green debt structure resembles a revenue-backed debt structure in which an investor’s interest and stake in a project are secured by the project’s revenues. The debt is structured in such a way that investors are introduced to local or statewide environmental resilience projects (green infrastructure projects) for which they provide upfront funding while choosing to share the project’s revenues and risks.

However, green bonds are not limited to only providing funding for green initiatives for local and statewide governments; they also encourage private-public partnerships. They have emerged as a key way to obtain funding for projects that may have been difficult to finance in the past. In addition, many governments are now able to explore and pilot new and innovative projects with green capital that may not have been accessible through traditional bond issuances.

Future of Green Debt

The future of green debt looks promising as more local government leaders understand the long-term value in green initiatives and the public/investors demand it from their respective representatives. It’s also important to notice that the coastal state and local governments will need to invest more in their green initiatives in the wake of rising sea levels.

The Standard and Poor Rating (S&P) 2019 US Municipal Green Bond and Resiliency Outlook outlines the following: “In the long run, we believe that U.S. municipal issuers have a natural advantage in issuing green and sustainability-labeled bonds. For example, we have previously highlighted the strong alignment between the goals of public water and sewer utilities and ESG principles.”

The world keeps warming and, with it, the growing awareness that the nation’s infrastructure, especially near coastlines, is at risk of costly damage due to the effects of climate- or weather-related events. The economic and financial implications are substantial, as evidenced by the price tags of damage from weather-related events, and the number of economic assets increasingly concentrated in coastal urban areas.

Adaptation projects improve the resilience of buildings and other infrastructure against the risks associated with extreme weather or longer-term shifts, such as sea-level rise in general. As sea levels get higher and storm and wildfire damage intensifies, we expect the motivation for municipal issuers to invest in improving infrastructure resilience through adaptation projects will only increase.”

Dont forget to check out our take here on understanding the comprehensive annual financial reports (CAFR) as reported by your local, state and other government entities.

Key Consideration for Investors

One of the main concerns that often comes up with green debt investments is the assurance that proceeds marketed as green bonds will not be applied to appropriate projects. This also creates a reputation risk for the underwriting firm managing the issuance to ensure that debt proceeds are spent on the intended projects.

The MSRB highlights a few key points for investors to understand before looking into green debt investments:

- In order to align your environmental and social values with an investment, investors must understand the project and the rationale behind issuing green debt.

- Investors must review whether the issuer of the green debt completed the Climate Bond Standard and Certification Process.

- Investors should also look into the issuer’s plan to measure and report the impact of the financing on the stated green purpose of the bonds.

- Finally, if the issuer has issued green bonds in the past, how diligent and effective was the issuer in measuring and reporting the green objectives.

Click here to learn everything you want to know about MSRB.

The Bottom Line

Where municipal debt is often bought and sold for its tax-free returns, low default rates and high credit rating, green investors are able to further align their social values with particular projects to responsibly enhance their investment objectives.

Sign up for our free newsletter to get the latest news on municipal bonds delivered to your inbox.

Disclaimer: The opinions and statements expressed in this article are for informational purposes only and are not intended to provide investment advice or guidance in any way and do not represent a solicitation to buy, sell or hold any of the securities mentioned. Opinions and statements expressed reflect only the view or judgement of the author(s) at the time of publication and are subject to change without notice. Information has been derived from sources deemed to be reliable, the reliability of which is not guaranteed. Readers are encouraged to obtain official statements and other disclosure documents on their own and/or to consult with their own investment professionals and advisers prior to making any investment decisions.