As the U.S. economy continues its longest period of growth and expansion, many leading economists have been warning investors of the inevitable slowdown of the economy, potentially leading to a recession.

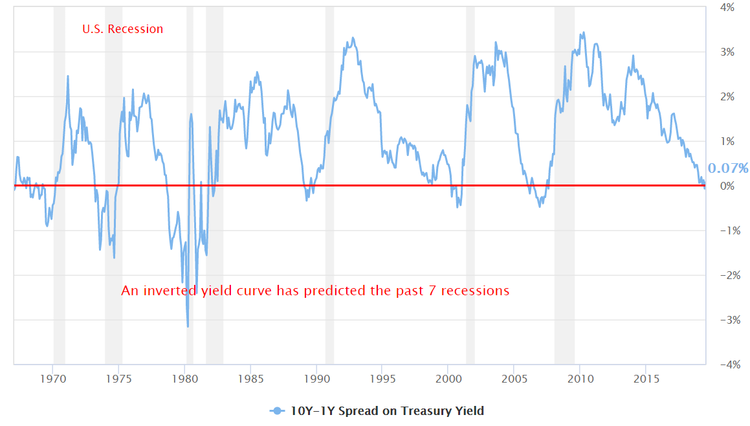

Where some economic indicators such as the ISM manufacturing index, inflation and initial jobless claims suggest a strong growth continuation of the U.S. economy, other indicators suggest the opposite. In March 2019, one of the leading and most reliable recession indicators, the yield curve, witnessed an inversion where the yield on 10-year \treasuries fell below the 3-month yield for the first time since 2007 when the U.S witnessed one of the worst economic downturns in history.

In this article, we will take a closer look at the looming concerns for investors in municipal debt, some critical checks before investing in municipal debt instruments and a temperature check for local government leaders to see if they are prepared for an economic downturn in their respective jurisdictions.

Be sure to check out our Education Section to learn more about municipal bonds.

Inverted Yield Curve and Its Impact on Fixed-Income Portfolios

As investors have been fearful of the interest rate environment and slowdown of the U.S. economy, in its most recent meeting in June, the Federal Open Market Commission (FOMC) decided to leave the fed funds rate unchanged and hinted towards future rate cuts rather than hikes for the remainder of 2019. The FOMC’s stance and investor outlook on the interest rate environment were quite different towards the end of last year when almost every industry professional anticipated the interest rate hikes to continue throughout 2019.

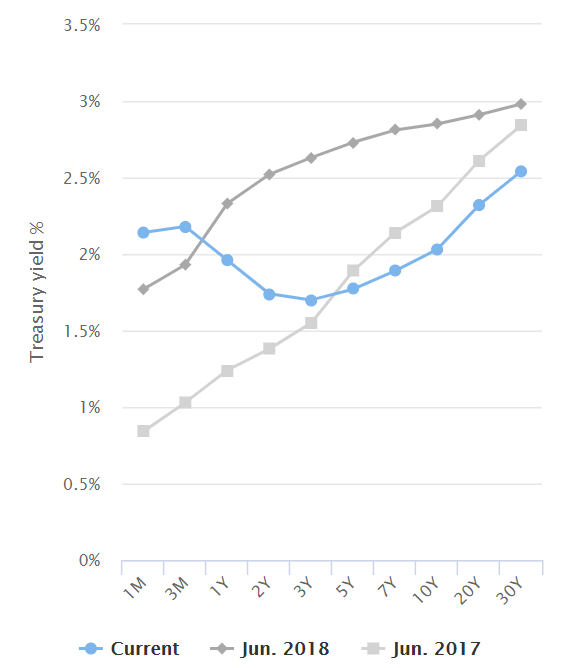

Before understanding the impacts of FOMC’s decision to hike or cut short-term interest rates, let’s take a quick look at the current inverted shape of the yield curve compared to the shapes from the previous two years.

In simple terms, the yield curve is a graph that plots yields on debt instruments from shorter (3 months) to longer maturities (30 years). The y-axis of the yield curve graph represents the interest rate an investor would expect to receive on a debt instrument, while the x-axis represents the time to maturity. Like any investment instrument, if an investor is investing his or her capital for a longer period of time, he should expect to receive a higher return than an investor deciding on a short-term investment. Therefore, short-term bonds typically offer lower coupons than longer maturities.

The current inversion of the yield curve makes many investors rethink their investment holdings because historically almost every yield curve inversion has always been followed by an economic recession in the U.S. economy, as shown in the graph below.

FOMC’s recent decision to maintain the short-term rate and potentially cut rates in the future indicates that the Fed believes the economy is still expanding and will continue to do so. This also means that as the curve normalizes with the rate cuts, the long-term debt will become more attractive for investors. In addition, the current holders of municipal or other fixed-income instruments may also be able to witness unrealized losses diminish over time.

Check out this article to learn more about Treasury and muni yield curves.

Key Consideration for Investors in Municipal Debt

As investors watch the FOMC on its stance on the future of interest rates and potential cuts, municipal debt holders and prospective investors must also consider other risks that can potentially jeopardize your investments.

Credit Risk

This type of risk is directly attributed to the issuer of municipal debt and alludes to its inability to pay back the borrowed debt or make scheduled coupon payments to its debt holders – also known as default. Although municipal default rates are extremely low, it’s still a cause of concern. In local and state governments, the credit risk is often assessed by reviewing the following areas:

- Sustainable Tax Base: The main basis for repaying general obligation debt is the strength and ability of the local economy – which includes the size, diversity of employers and strong tax base – to meet its financial obligations. Since real estate, their diverse ownerships and their values are critical for sustainable tax-base income levels, they also play an important part.

- Financial Preparedness: A local government’s organizational style and financial preparedness determine its ability to withstand any potential downturns and sustainability. This preparedness isn’t limited to its reliance on general fund revenues, but it also takes into account the potential policies in place for an unforeseen event, including reserve fund policy, access and management of liquid resources, and feasibility of long-range financial plans

Call and Liquidity Risk

Municipal issuers often exercise the call option on their high-coupon paying outstanding debt in a low interest rate environment, which essentially means that they can retire their outstanding bonds before maturity by either buying back or refunding them with lower coupon debt.

This poses a significant risk for investors whose debt has been retired by the issuer. The investors now have to go back into the municipal markets to buy other investment vehicles and they may never be able to earn the same interest as they were earning on the retired debt instruments. In addition, since municipal debt markets are not as active as equity markets, investors can often struggle to buy or sell their instruments in their desired time-frame.

Use our Screener to find the right municipal bonds for your portfolio.

The Bottom Line

As the U.S. economy continues its strong run, debt investors must consider the potential opportunities presented by the potential future rate cuts. The FOMC has been quite clear in its recent stance about cutting rates, which means that any long-term debt currently selling at a discount can be a lucrative investment and potentially sold at par or a premium as the rates normalize on the yield curve. In addition, investors must also carefully analyze the financial preparedness of their respective debt-issuing agencies.

Investors must consult with their financial advisors and tax consultants on their holdings, and it’s important to understand the tax status of any fixed-income instrument that you buy in the future, as it may have changed.

Sign up for our free newsletter to get the latest news on municipal bonds delivered to your inbox.

Disclaimer: The opinions and statements expressed in this article are for informational purposes only and are not intended to provide investment advice or guidance in any way and do not represent a solicitation to buy, sell or hold any of the securities mentioned. Opinions and statements expressed reflect only the view or judgement of the author(s) at the time of publication and are subject to change without notice. Information has been derived from sources deemed to be reliable, the reliability of which is not guaranteed. Readers are encouraged to obtain official statements and other disclosure documents on their own and/or to consult with their own investment professionals and advisers prior to making any investment decisions.